The Housing Affordability Toolkit

Housing stakeholders must be prepared to evaluate their housing market and effectively advocate for local housing policies in diverse communities across the nation. Download The Housing Affordability Toolkit to learn more about the relationship between costs and rents, how state and local policies impact affordability and facilitate conversations that result in the enaction of effective local housing policies.

Many communities across the U.S. are seeking solutions to a lack of affordable housing. To help them, we offer the Housing Affordability Toolkit. It is designed to help policy makers understand the dynamics of the housing market, what drives housing costs up, how state and local policies impact affordability and what solutions might work in their specific jurisdiction. Our goal with the Toolkit is to help educate all stakeholders — policymakers, community advocates, urban planners, business groups and more — and to provide apartment firms with the information they need to help advocate effective local housing policies.

Using the toolkit: Each section can stand alone or be combined with other sections of the Toolkit to help guide discussions regarding specific policies, tools, or incentives.

Developed in partnership with HR&A Advisors, the Housing Affordability Toolkit is divided into six sections and each section delves into a specific component of addressing the affordability challenge.

June 2021 Update: A Look at Affordability Post-Pandemic

In the June 2021 edition of NMHC Research Notes, NMHC Vice President of Research Caitlin Walter, Ph.D., reexamines this toolkit through the lens of the pandemic and ensuing economic downturn, which has put lower-income apartment residents at particular financial risk. What’s clear is that the affordability crisis has worsened over the course of the pandemic and while temporary government efforts to mitigate the economic effects of the pandemic helped, the underlying factors—from a significant supply/demand imbalance to rising development costs—have grown significantly. Read more >>>

Navigate the Toolkit

National Trends

The combination of a shortage in rental housing, rising development costs and stagnant incomes are driving the growing housing affordability crisis affecting U.S. cities. This section outlines the major drivers impacting housing affordability in order to inform conversations in a variety of housing market types. The National Trends section can be used to help communicate broad housing market trends and explain the need for additional multifamily housing development.

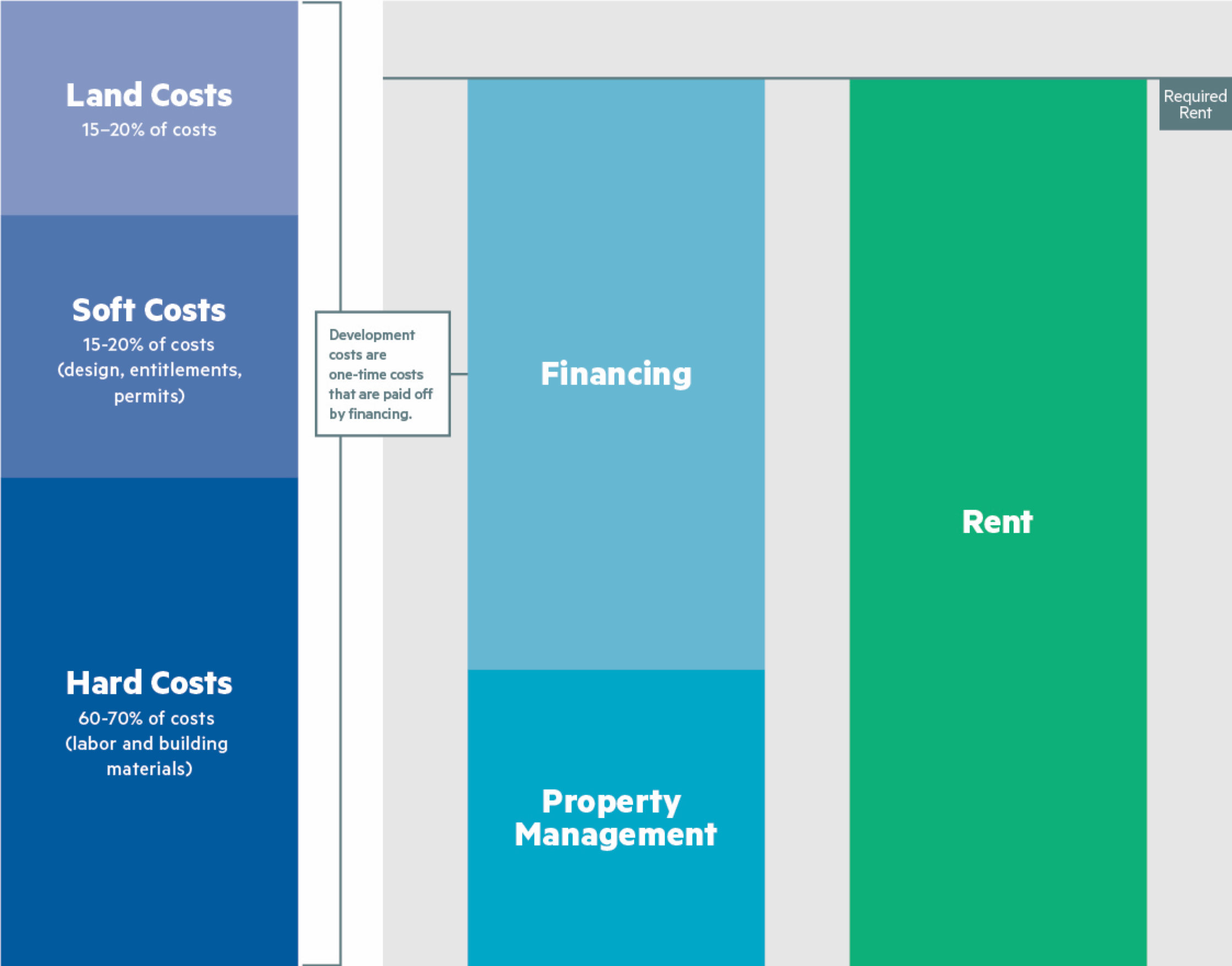

Cost Drivers

Housing Cost Drivers provides clear visuals that show the impact of policies or regulations in the housing market. The section consists of an overview of cost drivers; robust and illustrative examples of policies, regulations, and incentives; and an assessment of how these measures impact the cost of housing. It also includes survey-generated market information on development costs and quantifies the costs of onerous regulations and policies. Each scenario can stand alone, giving users the opportunity to select examples that are most relevant to their current regulatory climate to show the often-unseen connection between housing regulations or policies and cost increases.

Multifamily Benefits

Comprising 15% (20.6 million units) of the nation’s housing stock, multifamily rental housing plays a vast and diverse housing role that serves an essential and evolving purpose in communities across the country. At its core, multifamily housing increases the density, variety, and efficiency of a municipality’s housing. Explores the extensive benefits of multifamily housing while dispelling several misconceptions.

Affordability Strategies

The Housing Affordability Strategies provide in-depth descriptions of tools, policies, and incentives to support housing affordability in a wide variety of housing market types and communities. Each strategy is described in detail and includes recommendations for structuring and implementing the policy, tool, or incentive in question.

Using this section, users will be able to effectively advocate for strategies that support housing development and help address housing affordability challenges in their target markets. For policies already under consideration, this section will help users work with local officials and housing advocates to structure policies in ways that are most effective at encouraging housing development and least harmful to housing affordability.

Incentives to Develop

Housing development incentives can expand, diversify, and accelerate the production of affordably priced rental housing. A local government may employ a variety of mechanisms to incentivize the development of housing, whether by altering regulatory restrictions or by providing direct and indirect forms of support. Whatever the mechanism, these incentives ultimately increase revenue streams or decrease costs for a given development, thus increasing a project’s likelihood of being developed.

Tools

Each strategy (or tool) in this section can stand alone or be combined with other sections of the Toolkit to bolster the recommendations within the Housing Affordability Strategies to guide discussions regarding specific policies, tools, or incentives.

By-Right Development

By-right development impacts affordability in two key ways – it reduces the cost of development and increases the supply of housing.

Inclusionary Zoning

Inclusionary zoning policies can increase affordability if they are flexible, properly structured with sufficient incentives, and limited to strong housing markets.

Public Land Economics

Selling public land at a below market price to subsidize the development of housing can improve affordability in a community.

Tax Abatement

Property tax incentives improve affordability by directly lowering rents or increasing the supply of rental housing.

Rent Control

Rent control is a counterproductive housing policy that does not address any of the key factors driving housing affordability.

Case Studies

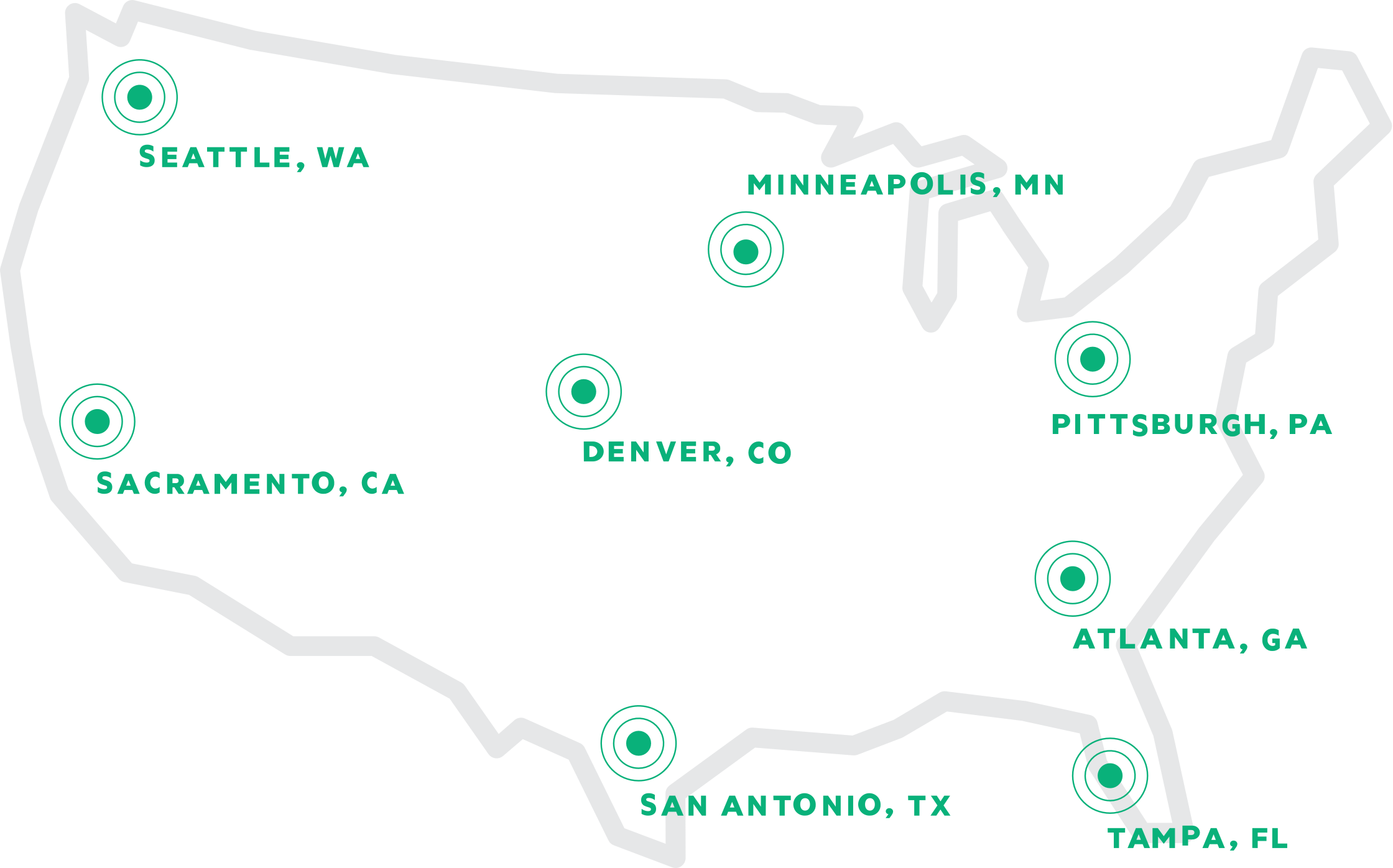

The case studies illustrate different housing market conditions, reflecting common sets of challenges cities face. Stakeholders can use one or more case studies to compare and contrast local issues with issues in well-understood housing markets. Use one or more case studies to compare and contrast local issues with issues in well understood housing markets.

Atlanta

Atlanta is experiencing strong population growth and worsening affordability challenges, affecting the ability of low- and middle-income renters to afford to live in the city.

Cities facing similar challenges:

Houston, TX; Columbus, OH; Irving, TX; Columbia, SC

Denver

The rental market in Denver has grown rapidly in recent years. Much of the new housing stock is targeted at a growing segment of high-income renters.

Cities facing similar challenges:

San Diego, CA; Portland, OR; Honolulu, HI; Austin, TX

Minneapolis

Minneapolis is experiencing modest growth, limited new development, and moderately increasing rents, which have posed affordability challenges for low-income renters.

Cities facing similar challenges:

Charlotte, NC; Raleigh, NC; Louisville, KY; Colorado Springs, CO

Pittsburgh

Pittsburgh is home to a large number of low-income renters who are vulnerable to even modest increases in rent. However, the city’s cost of rental housing is still relatively low.

Cities facing similar challenges:

St. Louis, MO; Norfolk, VA; Kansas City, MO; Indianapolis, IN

Sacramento

A lack of new multifamily supply and rising renter incomes have rapidly increased rents. In what was once a relatively affordable market, low-and middle-income renters are increasingly at risk of displacement.

Cities/regions facing similar challenges:

Long Beach, CA; Orange County, CA; Providence, RI; Long Island, NY

San Antonio

San Antonio has added a large quantity of multifamily rental housing and remains a relatively low-cost market where the median renter earns $36,000 a year.

Cities facing similar challenges:

El Paso, TX; Nashville, TN; Oklahoma City, OK; Phoenix, AZ

Seattle

Despite significant levels of new development, historic growth in high-income renters has pushed up rents for new and existing units to persistently high levels.

Cities facing similar challenges:

Washington, DC; Boston, MA; San Francisco, CA; San Jose, CA

Tampa

Tampa’s low cost of living has long been attractive to lower-income renters, but rising rents have begun to erode this affordability.

Cities facing similar challenges:

Las Vegas, NV; Riverside, CA; Spokane, WA; Charleston, SC