APARTMENT DEVELOPMENT FRAMEWORK

The Apartment Development Framework is intended to provide a simplified structure of a typical apartment cash flow to help demonstrate how external cost drivers can impact rents and development feasibility. This framework builds off work from the Urban Land Institute and Enterprise Community Partners’ 2014 report “Bending the Cost Curve,” as well as Rick Peiser’s “Professional Real Estate Development: The ULI Guide to Business” from 2012.

To test the effect of various regulatory and market impacts on a prototypical apartment development, HR&A developed a high-level proforma to model a hypothetical apartment’s financial return based on costs, revenues, and capital assumptions.

DEVELOPING THE APARTMENT DEVELOPMENT FRAMEWORK

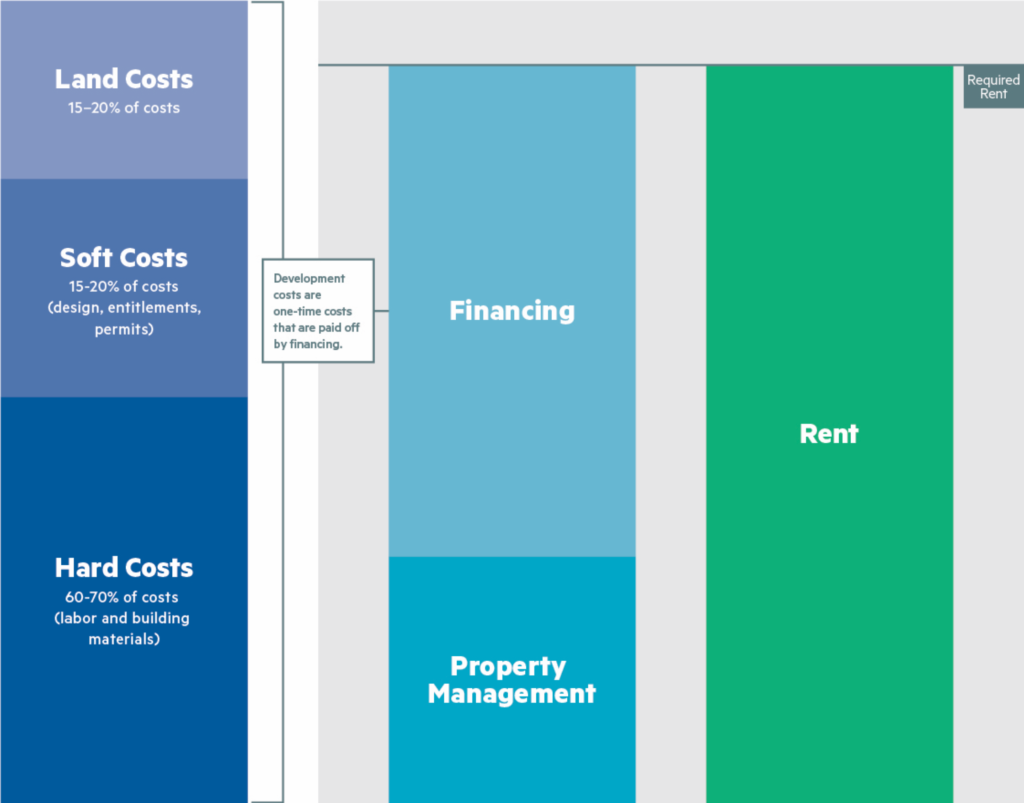

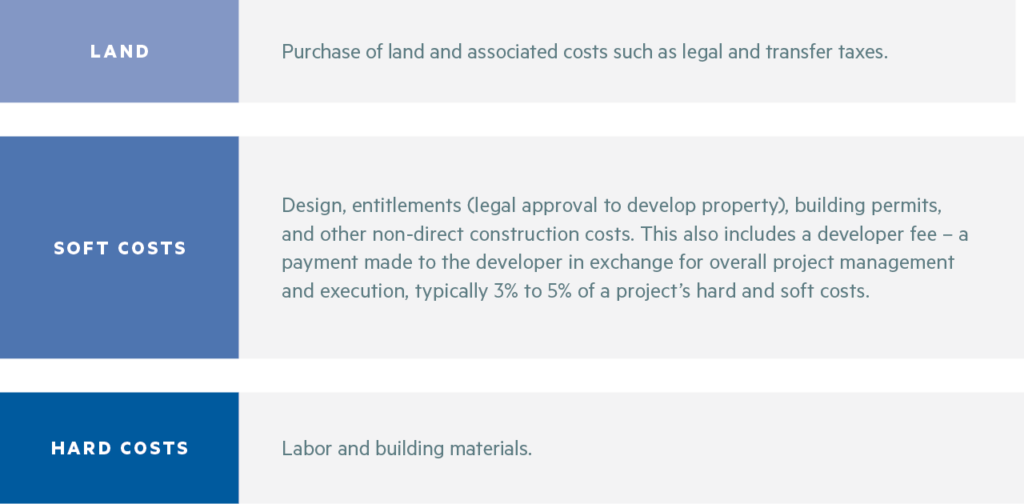

The apartment development framework was a result of an iterative design process that builds off the understanding that development costs influence the operating costs for a property, which determine the rent required to make a project feasible. Constructing new apartments incurs development costs – land costs, hard costs (labor and building materials), and soft costs (design, entitlements, and permitting) that are largely paid for with external financing. As development costs increase, more financing is required to cover these costs – increasing overall operating expenses. In turn, these operating expenses are supported by the revenue that a project can generate through rent. As operating expenses increase, the rent must increase in tandem to support the project and maintain feasibility.

DEVELOPMENT COSTS

Costs associated with planning, designing, and constructing apartments. These costs are further divided into three categories:

OPERATING EXPENSES

Costs associated with operating and maintaining apartments after construction.

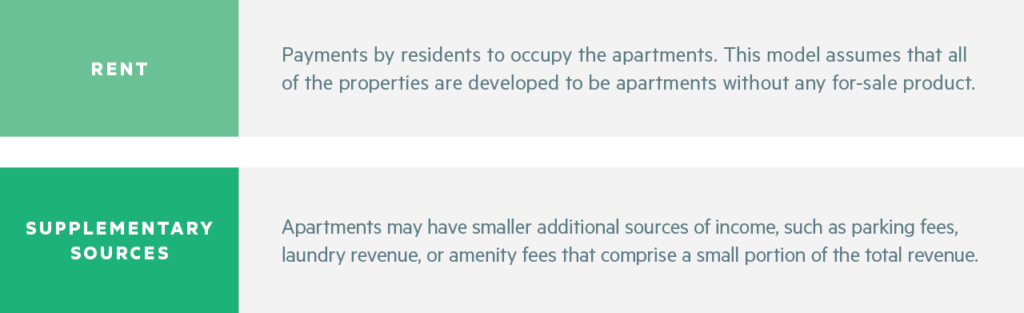

REVENUE

Income generated by the property.

TESTING REGULATORY AND MARKET IMPACTS

The apartment development framework was used to develop a high-level proforma to evaluate the impacts of regulation on a hypothetical apartment project. To ground the proforma and develop assumptions, HR&A selected a prototypical garden-style apartment in a strong second-tier market. Garden apartments are low-rise multifamily communities, characterized by a considerable amount of open space around multiple buildings and surface parking. These communities can be found across the country – at the outer edges of cities and in suburbs.

HR&A sourced these assumptions through a survey instrument that was disseminated to NMHC members across the country that asked for development cost, revenue, and financial return assumptions. HR&A then verified and anonymized these responses into prototypical development typologies to test scenarios. This data was supplemented with a targeted multifamily market scan to gather rent, vacancy, construction cost, and operating cost information from a variety of proprietary data sources to ensure that the proforma was representative of the product type and not beholden to project-specific considerations. A full list of assumptions can be found in Table 1.

Representative assumptions are a moving target. With rapidly increasing construction costs and market volatility, this analysis is meant to be demonstrative of the magnitude of impact from regulations, rather than an exact representation of rent and development costs. The changes in rent assume a fixed required equity return –investors have minimum market-driven expectation of return without which they will invest in other financial products. Based on the survey instrument and interviews with active developers, HR&A selected a 16% leveraged internal rate-of-return (IRR) as the benchmark financial return metric for this analysis. Return expectations can vary widely based on the regional market, perceived risk, and the opportunity cost of capital.

For each regulation, the “new rent required” metric is calculated to answer the following question: “if the return metrics were held constant despite a change in the regulatory environment, what would be the minimum rent required to clear the default 16% IRR threshold?” This change is the difference between “old rent” and “new rent.” For example, in the $1.5M increase in hard costs for stormwater retention, the increase results in a new required rent of $1,980 – an increase of $80 per month for an average 2-bedroom unit.

For other metrics in the report, HR&A conducted the same exercise of developing and testing assumptions and adjusting regulatory scenarios for different product types (mid-rise developments, high-rise developments, etc.) in different markets.